Note: This article is the twelfth in an ongoing series for Angel Investors. To learn more about developing the key skills needed to make great investments, download this free eBook today Angel 201: The 4 Critical Skills Every Angel Should Master or purchase our books at Amazon.com.

Ask a great investor what factors are most critical in his/her success in selecting investments and you will probably hear some variation on the following list:

1) Great Team

2) Great Idea

4) Innovative Business Model

When we evaluate companies, as you have read in past articles, we spend a lot of time analyzing these factors. And that’s because they are critically important. But there is one other factor that most people don’t think about and very few track.

So what is this key factor?? It’s Timing!

Not what you were expecting, was it? Let’s take you through it and, we expect you will understand why you need to consider timing as part of your overall investment planning.

Q: Ham, start us out here. Please be more specific about what you mean by timing?

I look at the issue of timing and ask two questions when I think about making an investment. First, I ask the timing question:

Is this the right time for this idea?

There is a lot of nuance in this question. It could mean that the world is not ready for it. For example, way back in 1994, Time Warner teamed up with Silicon Graphics to build a video-on-demand service in Orlando, Florida. Unfortunately, this project failed miserably. There were issues around high costs, difficulties with network infrastructure, and on and on. Does that mean it was a terrible idea? Of course not: fast forward 15 years and you are surrounded by fast-growing video on demand services. What accounts for the difference? Timing. All of the blocking issues went away because of the availability and reduced cost of leveraging high speed broadband throughout most of the world. Companies like Netflix are huge businesses today because people want video-on-demand and they can purchase a great product at a reasonable price.

Another way to parse this question would be to ask if the company is too late. For instance, we all know that Google wasn’t the first search engine. Yahoo, Infoseek and AltaVista are a few of the many search engines that were available years before Google came to market. Google ended up dominating the market. So Google wasn't too late because it was still a developing market. But obviously, that window of opportunity starts to close at some point. Today, if you want to build a new search engine, it’s going to be very difficult to get traction and take away significant market share from Google.

The second timing question I ask when making an investment is:

When do I expect this investment to mature and reach an exit?

This timing question relates less to what is going on in a specific industry, and more to what’s going on in the broader economy and the stock market. Imagine you are an investor in 1999 and you are invested in larger faster-growing internet companies that were experiencing significant traction. Your timing is great - the IPO market was red hot, so you could exit your investments and make a ton of money. Now, imagine you are an investor in 1999 and you are making your initial investments into young startup companies. Your timing is awful! The dotcom bubble burst in 2000 and most of your investments went to zero. VCs who raised new funds in 1996 and 1997 made a killing. Those who raised new funds in 1999 and 2000 went bust.

You don’t have any control over what goes on with the economy or the stock market. So what can you do as an investor to make sure you don’t end up losing it all due to bad timing? Here’s where a different type of diversification kicks in. If you look at your portfolio and plot out when you think your investments will exit, does it cluster around a short timeframe? Are they all trendy “it” companies of the moment which are raising inflated rounds at inflated prices? If so, you need to diversify in a different way by adding investments that will build value more slowly based on fundamentals and exit over a broader time period. If you invest in 20 or more companies and you make your investments at a steady pace of 2 to 4 new companies per year, you should have built-in timing diversification. That said, it’s a useful exercise to revisit your portfolio and examine when you think exits are most likely given the progress made by each company.

Q: Since we need to track timing as part of our overall portfolio diversification, how do we do it?

You need to have some way of organizing your angel investment portfolio. You should know exactly how many investments you have, when you made those investments and how well the investments are doing. Keeping all this information in one, well organized location sounds daunting, but it doesn’t have to be. It’s the main reason we developed Seraf, and I use it to manage my personal angel portfolio and to manage the Launchpad Venture Group portfolio.

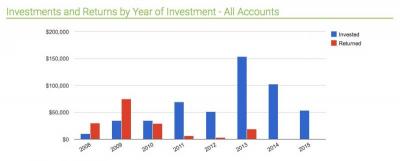

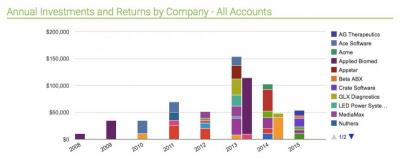

With simple charts like these, you have a sense for when you’ve made your investments, and are able to see whether they are spread out over time or clustered in short time periods. Overlay that information with an understanding of how much progress your investments are making, and you will get a sense for how many companies might exit in the near and mid-term. Too many exits focused on a short period of time adds risk to your portfolio.

Want to learn more about building an angel portfolio and developing the key skills needed to make great investments? Download Angel 101: A Primer for Angel Investors and Angel 201: The 4 Critical Skills Every Angel Should Master for free, or purchase our books at Amazon.com.