Seraf has been such an outstanding tool for us, and particularly useful for tracking our female-founded portfolio companies' KPIs and IRRs. This provides a more nuanced understanding of each of our individual investments, and helps drive our strategy on how best to support our founders for positive outcomes.

Portfolio Management for Early Stage Investors

Portfolio Management For Early Stage Investors

Portfolio Management for Early Stage Investors

All Your Info. One Place. Smart Investing.

Request a Demo

Seraf Empowers Investors Worldwide

Seraf Empowers Investors Worldwide

$11.8B

In Assets

20,330

Portfolio Companies

220,360

Transactions

Pick the Seraf Solution that

is Right for You

Enterprise

Contact Us for Pricing

Specialized Tools

to Manage Your Portfolio

What Makes Seraf Different

Easy Workflow

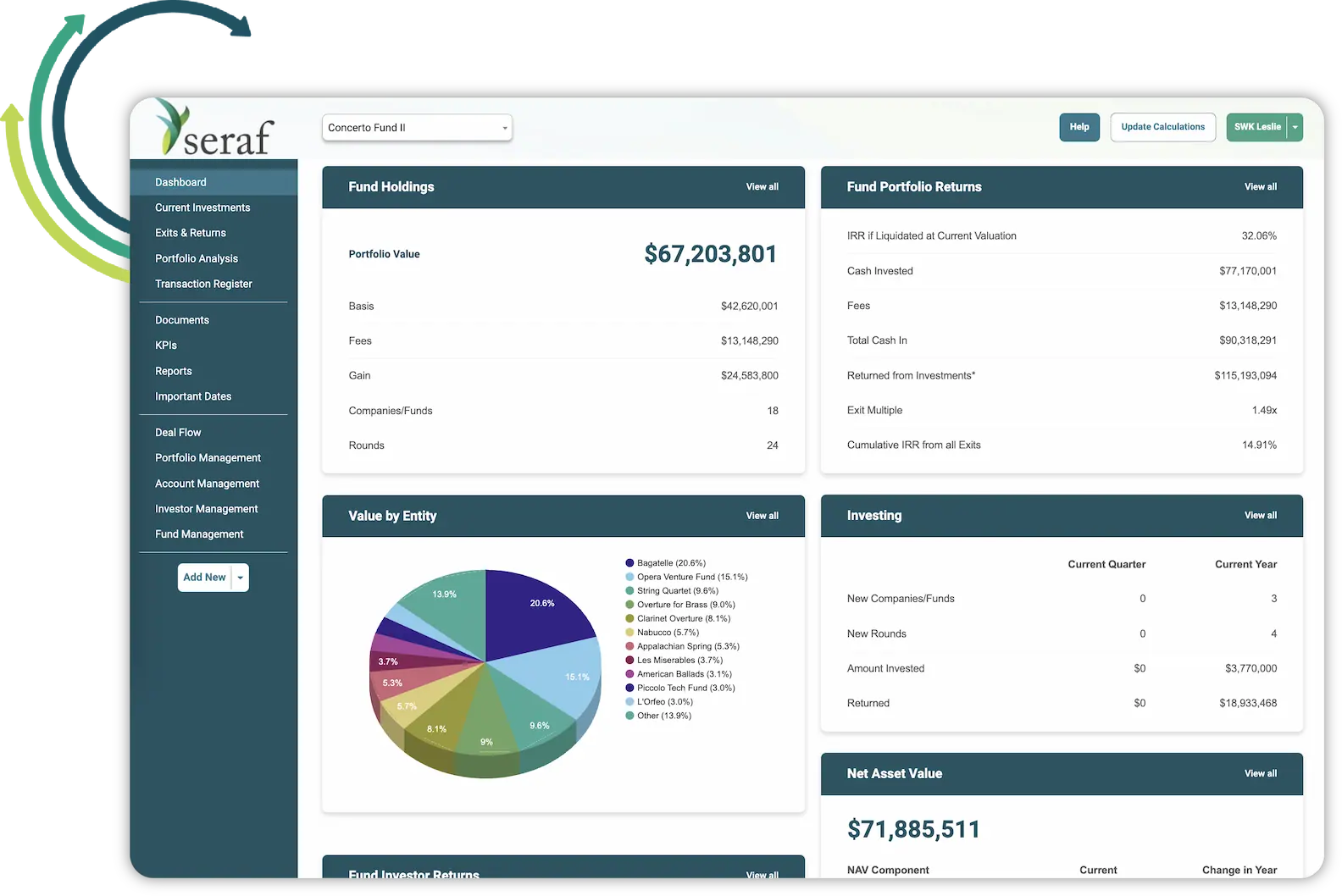

Seraf guides you through a few easy steps to get your portfolio up and running quickly. Get an overview, develop insights and generate reports in no time.

Deep Experience

Designed by active, early stage investors with over 25 years experience in fund creation and management, Seraf efficiently handles the complexities of today's early stage investment landscape.

Uniquely Focused Solution

Developed specifically to meet the needs of early stage investors, Seraf provides the precise tools YOU need to manage your portfolio efficiently.

The Seraf Compass

Our award-winning resource center with hundreds of articles, downloadable templates, checklists, eBooks and video interviews on key early stage investing topics. Learn best practices and gain powerful insights to help you achieve superior investing results.

Join over 12K weekly readers in learning about all things startup investing!

Seraf Toolbox: Due Diligence Checklist

We have written quite a bit about the importance of thorough diligence...

VC - A Practical Guide to Fund Formation

This series of articles is written for fund managers who are creating...

Angel Investing: Valuation, Capitalization and Startup Economics

So, which is the right method for an angel looking for long-term returns?...