Note: This article is the ninth in an ongoing series for angels new to investing. To learn more about building an angel portfolio, download this free eBook today Angel 101: A Primer for Angel Investors or purchase our books at Amazon.com.

After a year or two down the path of building a diversified portfolio of angel investments, many individual angels are faced with some uncertainty about their path forward. The questions on many experienced angels’ minds are “Will I make a good enough return on my angel investments to justify the risk? Should I continue to invest?”

Having spent the past 15 years as an active angel investor in Boston, managing a large angel group, and keeping up-to-date with angel activities around the US, Ham has a great perch from which to develop a perspective on what it takes to go from investment to exit.

Q: At Launchpad, we worked on a research project to understand the different kinds of exits we had in our portfolio. Give us a summary on the research methodology and findings?

At the time of our research project in the Fall of 2012, we had 17 exits in our angel group (it’s now about 24 exits). About half the exits were positive exits and the other half each returned less than we originally invested. The sample size we examined was large enough to gather some interesting insights. We looked at each company and recorded the following data:

-

Time from initial investment to exit

-

Total number of rounds of investment

-

Types of investors (e.g. Angels, VCs, Corporate Investors, Friends & Family)

-

And finally, the amount of capital returned to investors

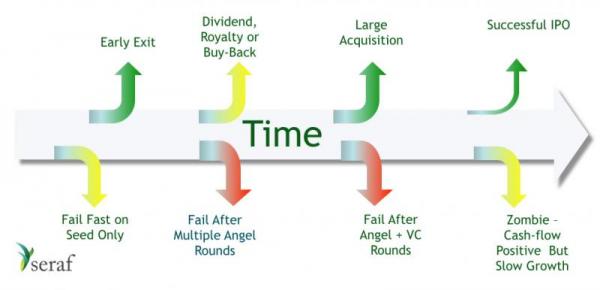

The chart below provides a visual explanation of what exits look like in the context of startup companies. We think this chart gives a great overview of what angel investors can and should expect within their angel investment portfolio.

So let’s walk through this chart in more detail. The arrows that point down represent the different ways companies fail and return less than the capital originally invested. These companies may return some capital, but for you the angel investor, you will see little return.

Fail Fast on Seed Only: If you are doing a good job finding companies, performing due diligence, and sizing the initial rounds to get to key milestones, there should be a limited number of companies in your portfolio that fail quickly. In our portfolio, these companies were usually characterized as early seed deals where a great idea didn’t pan out. The company raised a small amount of capital, but the technology didn’t work, or customers weren’t interested in buying for any one of a whole host of reasons. As seed investors, you decide to stop funding the company and the company can’t find any other investors. Although losing all your money in a seed deal doesn’t feel great, typically you put a small amount of money into the company at this stage. So your overall loss in time and money tends to be low. Remember, the only thing worse than a mistake, is an expensive mistake. A typical Fast Fail scenario has less than $1M invested in the company, and it took less than 18 months to fail.

Fail After Multiple Angel Rounds: This is probably the most common scenario for failed angel deals. You find a great team with an awesome product. The company makes some early progress, but not enough to raise a large follow-on round of financing. So you and your angel colleagues pony up a bridge round to help the company achieve the milestones that the big investors need to see. One bridge round turns into two or three bridge rounds, with the plausibility of each successive round buttressed by the human tendency to not want to admit you were wrong until you are absolutely forced to. So you chip into the pot to see the next card. Before you know it, you’ve invested 2x or 3x what you put into the first round, and it’s four years after you made your initial investment. And, the company continues to underachieve. At this point, the old investors are ready to bail, and new investors aren’t interested. So, if you are lucky, you unload the company at a fire sale price to some other company. In the end, you lost much, if not all, of your investment and you spent 4 years going through this exercise. A typical scenario in this situation has $1M to $3M invested in the company over a 3 to 5 year time frame.

Fail After Angel and VC Rounds: Some of the most promising startups end up in this bucket. The story goes something like this… you invest in the seed round, the company gets some early traction and shows good signs of product/market fit. Times are buoyant, competition for good deals is hot so VCs start to take interest and the company closes a Series A round of financing at a nice step up in valuation. On paper, your seed investment is now worth 3x what you invested. Things are looking good! Unfortunately, the initial success doesn’t pan out and growth stalls at the company. But, no one is willing to call it quits, so the VCs force a pivot or maybe some change to management and the company raises additional rounds of financing. Your initial stake in the company keeps getting diluted unless you pony up with additional funds at increasing valuations. In the end, the company gets sold or shut down and your return is zero. A typical scenario in this situation has $10M to $20M invested in the company over a 7 to 10 year time frame.

Zombie - Cash Flow Positive, but Slow Growth - No Liquidity: We’ve all invested in companies like this. The business grows slowly but surely. Revenues climb into the millions and the company can easily stay around cash flow break-even because it is only making modest investments in growth. However, the growth rate for the business is in the low single digits, the company cannot attract a big slug of capital to force growth, and the company remains below the radar of any potential buyer. This situation is relatively common with angel backed companies and less so with VC backed companies. The main reason for this is that VCs have to distribute the assets of their fund to their investors around the 10 to 13 year mark. Having to distribute stock in a private company is not ideal. So many VCs will force the sale of a zombie-like company. Angels are less motivated to force the sale of a company, so they end up holding their investment for much longer than they ever expected. Many zombies are just life style companies in disguise. The founding team has no motivation to sell because there are no interesting offers, they are drawing a nice salary and aren’t working as hard as they did in the early startup days. If you are an investor in a company that fits this description, get together with the other investors and work with the CEO to come up with an exit plan.

So we reviewed the not so good exits, but what about the positive exits? This is the fun and lucrative part of angel investing. What do those exits look like? Stay tuned for Part 2 of this article where we will review everything from an early exit to an IPO.

Want to learn more about building an angel portfolio and developing the key skills needed to make great investments? Download Angel 101: A Primer for Angel Investors and Angel Exits: Perspectives and Techniques for Maximizing Investment Returns, or purchase our books at Amazon.com.