This article is the eighth chapter of The Entrepreneur's Journey, a collection of stories about startup companies and the entrepreneurs who built them. To continue reading about key startup themes and lessons learned, check out the entire series here in The Seraf Compass, or purchase the book on Amazon in paperback or Kindle format.

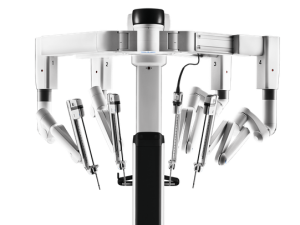

A wounded soldier, far from a trauma center, has a so-called golden hour to be treated for serious injury to maximize chances of survival. Surgical robotics initially were designed to treat these battlefield injuries as fast as possible, remotely. By remote, imagine the robot is in a location separate from the surgeon using it. The surgeon is in this second location performing the surgery. The robotic platform features arms positioned over the patient and surgical tools at the ends of each arm. A communications link connecting the surgeon to the platform allows her, while seeing an image of the patient on a screen, to manipulate surgical tools on the arms through a master hand device. The robot mimics the surgeon’s exact hand movements to perform the surgery. First pioneered in the early 1990’s, this futuristic technology is now available and used worldwide for multiple surgical applications requiring precision and consistency.

A wounded soldier, far from a trauma center, has a so-called golden hour to be treated for serious injury to maximize chances of survival. Surgical robotics initially were designed to treat these battlefield injuries as fast as possible, remotely. By remote, imagine the robot is in a location separate from the surgeon using it. The surgeon is in this second location performing the surgery. The robotic platform features arms positioned over the patient and surgical tools at the ends of each arm. A communications link connecting the surgeon to the platform allows her, while seeing an image of the patient on a screen, to manipulate surgical tools on the arms through a master hand device. The robot mimics the surgeon’s exact hand movements to perform the surgery. First pioneered in the early 1990’s, this futuristic technology is now available and used worldwide for multiple surgical applications requiring precision and consistency.

Intuitive Surgical was founded in 1995 by Dr. Fred Moll and Rob Younge. Its mission was to build and sell commercially feasible, sophisticated robotics for use in surgery. Today, the company is a powerful and enduring example of the impact competent leadership and a great team can have on a complex management challenge. Intuitive introduced robotic surgery to the lexicon of healthcare innovation. In the hands of a great leadership team, the company led the disruptive change robotics brought to the market. Intuitive established an entirely new product category and with it redefined the global practice of surgery.

Fred Moll is a medical device visionary. After graduating from the University of Washington Medical School, he began his surgical training and developed an interest in small incision laparoscopic surgery. In this type of surgery, a camera is inserted through a small incision in the umbilicus. The camera visualizes the internal organs and allows surgical tools, inserted through small incisions, to perform surgery. Fred co-founded Endotherapeutics to develop those tools. After its acquisition by US Surgical, he co-founded Origin Medsystems to continue the pursuit of his vision for creating innovative small incision surgery tools and techniques. In time, his career path would take him to the emerging world of surgical robotics.

_______________________

Intuitive’s story began in 1994 when Fred paid a visit to the Stanford Research Institute (SRI), an independent research institute in Menlo Park, California. Fred met with SRI engineer Phil Green. Phil and his team, working with the Department of Defense, had prototyped sophisticated robotics technology to treat wounded soldiers remotely. Fred understood if surgical robots worked as intended, they could disrupt the conservative profession of surgery and create an entirely new category of sophisticated medical technology. This was the impetus for his meeting with Phil. Even then, Fred believed, “Robotics could become the future of how surgery is practiced.”

Fred’s visit to SRI was every bit as inspiring as he hoped it would be. He immediately wanted to apply Phil and his team’s technology to non-military surgical applications. He believed robotics was a natural extension of minimally invasive surgery. He wondered if Origin, a cash and resource-strained startup at the time, could afford to take on the risk and cost of a robotics R&D project?

Fred knew a robotics project required focus, unique skills, and a long design and development process. Building a surgical robot is a complex challenge. It requires substantial capital to develop a working prototype and more capital to accommodate the slow adoption of new technologies in healthcare. After assessing the risks associated with these challenges, Origin’s senior management decided it made the most sense to spin out a new company called Intuitive Surgical which would license the robotics technology from SRI.

_______________________

Fred left his position at Origin Medsystems, and its parent Guidant, to be Intuitive’s first CEO. Fred had a clear strategy in mind to launch and build the company. His ambitious goal for the future of surgery, and his aggressive plans for how to accomplish it, inspired and motivated potential employees and investors. He was able to gather a strong team around him. As a leader he also understood his own limitations. He said, “My value-add is pattern recognition focused on products.” He knew professional investors needed more than just a product visionary in a founding team. They invest in teams with a mix of skills. In addition to the deep understanding of markets and products that Fred possessed, the company needed leaders with engineering, operations, manufacturing, finance, regulatory and marketing skills.

Fred started a search for a technical leader to help launch the company and raise the necessary financing. He sought the help of a leading healthcare investor, Mayfield Fund. Fred gained access to and support from two visionary physicians, Russell Hirsch, a Mayfield Partner, and John Freund, a Mayfield advisor, to find a world class technical lead. John introduced Fred to Rob Younge, an accomplished engineering and operations leader, and a proven entrepreneur. Rob was one of the co-founders of Acuson, a pioneer in the field of ultrasound imaging. Rob joined Intuitive as co-founder. This new, complex technical challenge and Intuitive’s ambitious mission excited Rob. He believed he had the technical chops to accomplish this herculean task.

With a co-founder at his side, Fred’s next challenge was raising capital, a challenge compounded by the complexity of this disruptive robotics technology and the capital-intensive nature of what Intuitive was trying to do. Investors’ market research showed Intuitive’s total addressable market could be huge. Robotics was used successfully in industries requiring precise, repeatable functionality. Robotic surgery might offer clinical benefits over traditional open surgery. But, disruptive change does not come easily in healthcare. It usually takes time and significant capital to support the product development and the marketing necessary to win over industry key opinion leaders. Fred recalls early conversations with surgeons, “One expressed abject horror at the idea of robotics. He asked if I was out of my mind. Another surgeon said it would be criminal to use robotics.”

The engagement of Russell Hirsch and John Freund at Mayfield Fund brought needed credibility to the company and its truly disruptive ideas. This credibility helped attract key new team members. Those team members, plus the robotics technology, which could redefine the practice of surgery, provoked lots of financing interest. Intuitive raised $5.5 million led by Mayfield Fund with participation from Sierra Ventures and several notable medical device industry veterans.

With cash in hand, the team set out to build the world's first commercial surgical robot, which they called DaVinci. They planned to prove the doubters wrong. The team developed a detailed operating plan. They hired key engineers including Dave Rosa, and built a working prototype to demonstrate the technology in an animal lab. Dave joined from Acuson. He said, “I had tremendous respect for Rob Younge, and Fred’s vision blew me away.”

_______________________

Having built a working prototype, Fred and the team felt the company was ready to move out of the deeply technical phase. They faced a critical decision. Given the scope of what the company was trying to do, they recognized the need to find a world class CEO. Changing leaders is always a pivotal decision, and with Intuitive it was made earlier than most young companies. Fred said, “If you’re creative, you’re usually not structured. I know I’m more on the creative end of the spectrum. We would need more structure.” Fred’s self-awareness and the willingness and alignment of the management team to find the right leader was a credit to the founders and proved critical to Intuitive’s ultimate success.

With the decision made, the CEO search began. Three quality candidates meeting the position specifications were identified. After a rigorous bi-directional screening process, Intuitive hired Lonnie Smith as their CEO in May 1997. Mayfield’s Russell Hirsch, also one of Intuitive’s founding investors, added, “We looked for a mature, experienced executive who could mentor and lead a young team to achieve its ambitious goals. We saw that in Lonnie. We also saw an intellect that fit in with the smart Intuitive team.”

Lonnie had broad and deep professional experience. He joined Intuitive from Hillenbrand Industries, a diversified Midwest manufacturing company. He had occupied positions of increasing responsibility over twenty years, the last as Senior Executive Vice President and board member. He did not, however, have experience at a venture-financed startup. Reflecting on Lonnie’s early tenure at Intuitive, engineer Dave Rosa said, “Startup experience didn't matter. Lonnie was all about content and substance. Company size was unimportant. Our mission and our vision excited him.”

Why was a seasoned executive like Lonnie interested in Intuitive? Lonnie said, “At the time I was interviewing for the CEO position at Intuitive, I was in discussions to join one of two successful billion dollar companies. During a call with my daughter, she asked where I was in my decision and I described my options. She said, ‘Dad, why don’t you do something that will make a difference?’ She reset my decision criteria and priorities. I believed Intuitive could make a significant and lasting difference. I took a 70% pay cut and moved to California from a company with ten thousand employees to a company with twelve.”

References confirmed Lonnie was a mature, credible, skilled and smart operating leader. Dave Rosa called him a great athlete. “He just seemed to do everything well and had a ton of experience doing it.” The team was comfortable with Lonnie and confident he could lead the company as it transitioned from an R&D organization to an operating business. And Lonnie was determined to bring only enough structure to Intuitive’s fast paced environment to get the job done, while allowing enough looseness to maintain its passion and excitement.

Given his experience, Lonnie understood the complexities of a capital equipment company. He set standards for effective capital deployment, inventory management, complex design processes, supply chains, and margins, all critical issues at Intuitive.

Operations were not Lonnie’s only focus as a leader. Early in his tenure he initiated a process to define Intuitive's culture. From experience Lonnie understood the importance of having shared values, goals and practices in a company. He knew companies often neglect the process of defining their culture, and regrettably allow a default culture to develop on its own. Intuitive did not. It memorialized its way of doing things and incorporated them into a living set of ‘Founding Principles’ and a ‘Statement of Purpose’ composed in 1997 and highlighted even today in the company’s annual report.

The inclusive process Lonnie used to create the company’s culture established Lonnie’s credibility as Intuitive’s leader. Perhaps the best indicator of hyper-performance in an organization is cultural alignment. Lonnie recognized the importance of starting out with a well-defined culture, a common purpose and getting everyone in alignment around that purpose. He said, “During my career, I had the opportunity to observe many leadership styles and company cultures. I saw Intuitive as an opportunity to try and incorporate the best of what I had learned.”

In addition to his leadership skills, Lonnie possessed business discipline. He challenged management to think about and help define Intuitive’s business model early as it transitioned to an operating company. Russell Hirsch said, “Lonnie was a business visionary. He challenged the board and management to help refine Fred’s vision from a brilliant technical idea to a legitimate business opportunity.”

In line with that thinking, Lonnie tested the company’s assumptions relative to its early clinical focus. Initially, the company set its sights on the formidable challenge of using its robots to perform minimally invasive coronary artery bypass surgery. What made this such a challenge was the need to design a machine which could work around a heart that was beating and moving.

Lonnie said, “We had hired a consulting firm to help us track a beating heart so we could design the robot to move with the heart while performing beating heart surgery. I was in the process of raising a second round of financing to keep us from running out of money. We were nowhere near a viable design of our basic surgical robot, and we were about to complicate the task by adding the ability of the entire machine to track a beating heart. I had to shut it down.” Lonnie felt the added complexity of pursuing this type of surgery would dramatically increase their costs and time to develop a commercial product. He believed the risks of such a challenging project far outweighed the benefits. Intuitive needed to complete the design of the basic surgical robot first.

In addition to recognizing the company was going after the wrong procedure, Lonnie knew he couldn’t build a high growth company selling costly capital equipment alone. He needed to build a surgical procedure-based business focused on usage and adoption. Dave Rosa said, “Lonnie focused on metrics measuring usage of the platform and usage by procedure.” Towards the end of 2001, Lonnie noted one clinical procedure exhibited a positive usage trend. “Prostatectomies showed consistent growth.” Lonnie plotted usage on an adoption curve. “I realized that robotic surgery adoption would occur procedure by procedure and that we had traction in urology.”

The robotic prostatectomy was a potentially large market for Intuitive. The company made investments to show clinical efficacy, to train surgeons, and to educate patients and doctors. Adoption was dramatic. One New York urologist said, “After purchasing our first robot, urology booked it for days at a time. Soon, we could only book it for a few hours at a time. We needed a second robot to meet patient demand.”

Intuitive gained confidence that sustained company growth would be driven by specific surgical procedure adoption, such as a prostatectomy, across other surgical specialties. With adoption, sales cycles shortened and revenue increased as hospitals tested and bought the DaVinci robot. Hospitals competed with one another. An early buyer marketed the robot in the community to generate consumer awareness. Patients then began asking about robotic surgery. If one institution had a robot, its competitors felt pressure to buy a robot too.

With the strategy of usage and adoption, the company also developed a line of so called ‘resposable’ surgical instruments, i.e. devices that were neither totally disposable nor totally reusable. Each surgical instrument was designed to have a finite effective life. This required hospitals to replace the instruments repeatedly for the life of the robot. This became Intuitive’s razor and blade model, a key component of the company’s highly profitable business model.

_______________________

To succeed, Lonnie had to confront many operational challenges particular to young capital equipment companies. He challenged lean teams to manage lengthy timelines and complex design processes. He pushed product development to design early generation products with the minimum features necessary, and no more. One time, the company was on its third iteration of a design. Everyone had ideas on more improvements. Lonnie asked the youngest engineer in the room, Dave Rosa, for his input. Dave said, “I think it’s good enough and we have more important things to do.” Fred Moll distinctly remembers that meeting. “You have to see through stages of new product development and ask what’s most important. Saying that is one thing. Lonnie made it happen.” Lonnie recounted, “We did as Dave suggested and moved on.”

Dave Rosa reflected, “Lonnie forced teams to problem solve not by throwing resources at them but with small, nimble teams, and holding them accountable.” This was by design. Lonnie deliberately set out Intuitive’s eight founding principles to guide the operation of the company. One of these principles, Small teams win, states, “We believe in small, agile teams of outstanding staff that deliver results.” A second principle is Believe the beliefs, Deliver the results. Dave said, “Accountability was a really, really big deal at Intuitive. Lonnie hired great people, held them to a high standard and made changes when needed.”

Another example of Lonnie’s focus on accountability comes from a story he recounted of an engineer leading a system redesign. Lonnie said, “He was skilled at creating Gantt charts but a weak technical leader. I told his manager the engineer needed to be replaced. The manager asked why and I said the engineer tried to lead the team over the hill twice. I doubted they would follow him a third time. Who should replace him? I suggested Gary Guthart as our best leader.” Fast forward over a number of years and Gary is now CEO of Intuitive. Lonnie had a great eye for talent.

Lonnie instituted processes to ensure innovation and product development would stay ahead of the market. He introduced future generations of products to maintain their market leading position. This drive to innovate was also reflected in Intuitive’s founding principle, “Innovation is essential to our success.”

Lonnie brought discipline to the organization’s Intellectual Property (IP) strategy and constantly enhanced its IP portfolio. At Intuitive, plaques of issued patents cover an entire wall. IP strategy was a critical component of the company culture. Fred Moll said, “A sophisticated and aggressive IP policy was in our DNA.”

Lonnie taught discipline and focus around margins and manufacturability, which young engineers integrated into their thinking. As to margins, Intuitive has been able to successfully achieve 75% gross profit margins at scale. Their robot is a million dollar piece of capital equipment with 3,000 parts. The operating challenge of achieving positive margins was real. Leadership met those challenges and helped determine the company’s destiny.

Lonnie also had a soft side. Dave Rosa said, “Lonnie constantly walked the building, speaking with team members, asking about families, often by name. He was a teacher and a prolific reader and used several books to inform his business acumen.” A favorite book was Barbarians to Bureaucrats: Corporate Life Cycle Strategies. According to Dave, “It really informed one of Lonnie’s core beliefs. Larger companies drift towards bloat with more money being spent on non-core activities. Lonnie pledged it would not happen here at Intuitive.”

Lonnie has been described as humble, honest, empowering, a great teacher, and a consummate professional. He set high standards. He held people accountable. He established a high performance culture and an operating framework designed to produce sustainable and consistent results. Having worked with many CEOs while at Mayfield Fund, Russell Hirsch recognized Lonnie as one of very few executives who could lead Intuitive’s complex technology and business challenge to success. He said, “Lonnie lived in the details of every functional silo. In the end, he could bring the disparate parts together to maximize value.” Dave Rosa added, “Lonnie struck a perfect balance between caring and humble, and relentless accountability.”

_______________________

As investors, our goal is to maximize returns in a reasonable period of time while assuming the lowest possible risk. Experience teaches investors that a great leader and team can maximize the probability of solid returns and therefore ranks at or close to the top of the list of factors we consider before writing a check. Research confirms startup success often depends on leadership and teams’ knowledge, passion and aligned objectives. Capable leadership of this type is what drove the success at Intuitive.

Intuitive Surgical had a successful IPO in 2000. Today, the company dominates the medical robotics market. Leadership’s vision has remained clear, strong and enduring. They currently enjoy annual revenues of $4 billion and an astounding $67 billion market cap. To date they have sold more than 6,000 robotic platforms used to perform eight million procedures globally. Lonnie Smith recently retired as company Chairman. Fred Moll left to found several other robotics companies. Fred predicted “Robotics would become the future of surgery.” It has. Intuitive is a model for entrepreneurs and investors, alike. It is perhaps one of the strongest demonstrations of the principle that success is about great leadership and a great team.

Interested in reading more stories about key startup themes and lessons learned? View the entire collection here in The Seraf Compass or purchase the book on Amazon in paperback or Kindle format.